Financial health of the U.S. government is of growing concern, especially with the revelation that interest payments on its debt have grown to consume 30% of its revenue. This development signifies a troubling trend with broad implications for fiscal policy, economic stability, and the nation’s ability to meet future obligations. To understand the gravity of this situation, it is essential to analyze the causes, implications, and potential solutions to this burgeoning issue.

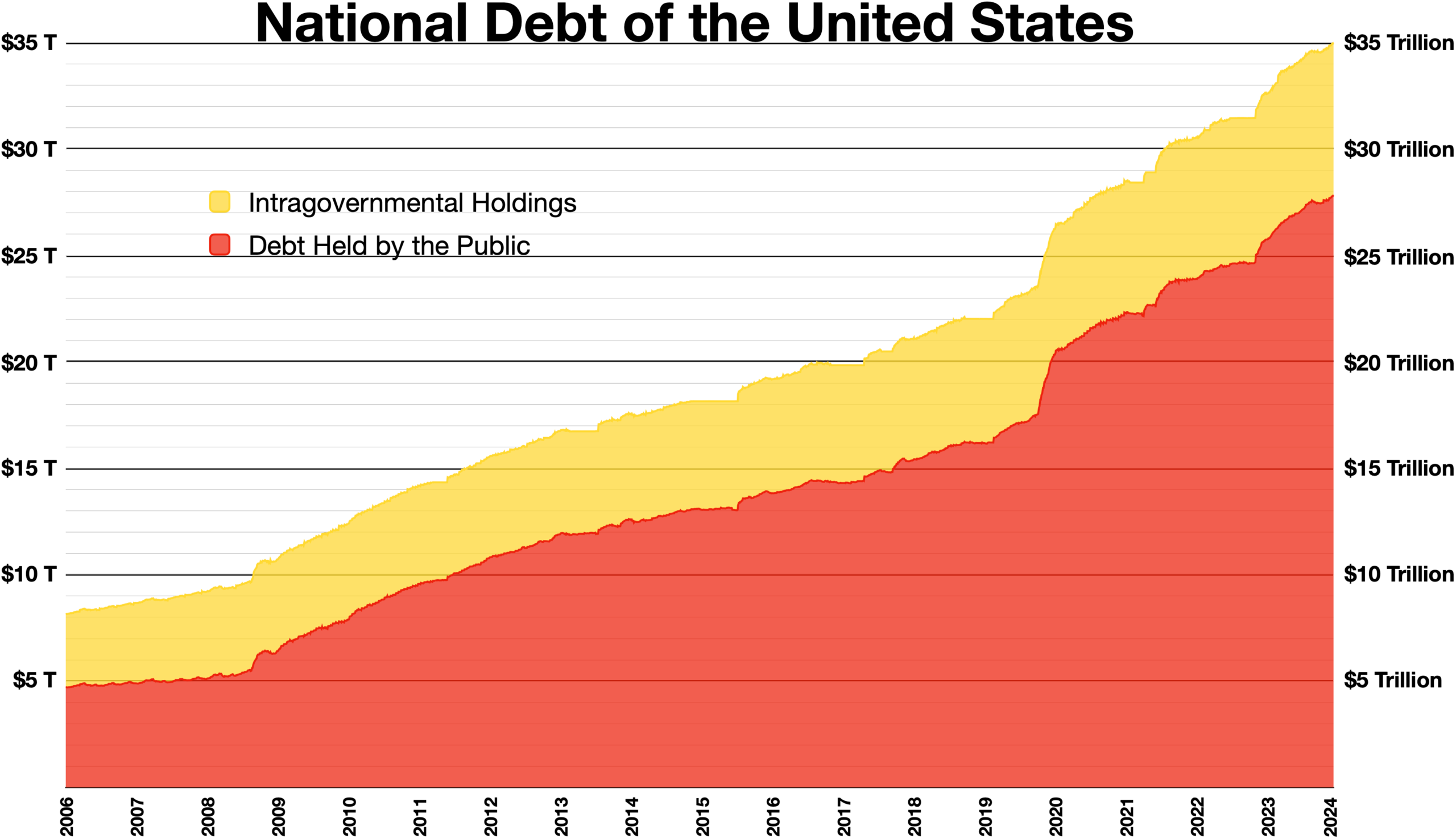

The United States has accumulated a substantial national debt, driven by consistent budget deficits where government spending exceeds revenue. The combination of tax cuts, increased defense and social spending, and the economic impact of events like the COVID-19 pandemic has exacerbated this trend. As of now, the national debt exceeds $30 trillion, and servicing this debt requires significant financial resources. With interest rates gradually rising, the cost of borrowing has increased, pushing interest payments to a substantial portion of federal revenue.

The 30% figure highlights the unsustainable nature of current fiscal practices. When nearly one-third of revenue is dedicated solely to interest payments, less is available for essential services such as healthcare, education, and infrastructure. This situation constrains the government’s ability to invest in long-term growth and meet its obligations to citizens.

The high proportion of revenue spent on interest payments can have several adverse economic consequences. Firstly, it can crowd out other government spending. With a significant portion of the budget locked into servicing debt, fewer resources are available for discretionary spending. This could lead to underfunding critical programs, reducing public investment in infrastructure, research, and development, which are essential for sustaining economic growth.

Secondly, high debt levels and associated interest payments can lead to reduced investor confidence. If investors perceive that the U.S. government is struggling to manage its debt, they may demand higher interest rates to compensate for the perceived risk. This can create a vicious cycle where increasing debt servicing costs further strain the budget, necessitating even more borrowing.

Moreover, substantial debt levels can limit the government’s ability to respond to economic crises. During recessions or other economic downturns, governments typically engage in deficit spending to stimulate the economy. However, if a large portion of revenue is already committed to interest payments, the ability to implement effective fiscal stimulus is significantly hampered.

Addressing the high level of debt and interest payments poses significant challenges for U.S. fiscal policy. The government faces the difficult task of balancing the need for fiscal consolidation with the risk of stifling economic growth. Austerity measures, such as reducing government spending or increasing taxes, can help reduce deficits but may also slow economic activity and harm vulnerable populations.

On the other hand, continuing to borrow at current levels without significant policy changes is unsustainable in the long run. It risks leading to a debt spiral where the government borrows more to pay off existing debt, resulting in an ever-increasing debt burden.

Policymakers must also consider the long-term implications of entitlement programs such as Social Security and Medicare. These programs represent significant future obligations, and without reforms, they will place additional pressure on the federal budget. Ensuring the sustainability of these programs while managing the current debt levels requires careful planning and bipartisan cooperation.

To improve the financial health of the U.S. government, a multifaceted approach is necessary. One potential solution is comprehensive tax reform aimed at increasing revenue without stifling economic growth. This could involve closing tax loopholes, increasing taxes on higher incomes, and ensuring that corporations pay their fair share. Such measures could help raise the necessary funds to reduce deficits and manage debt levels more effectively.

Expenditure reform is equally important. This involves evaluating government spending to identify areas where efficiencies can be achieved without compromising essential services. For example, defense spending, which constitutes a significant portion of the budget, could be scrutinized for potential savings. Additionally, healthcare reform aimed at reducing costs while improving outcomes could help manage the long-term liabilities associated with Medicare and Medicaid.

Entitlement reform is another critical area. Ensuring the sustainability of Social Security and Medicare requires difficult but necessary decisions. This might include measures such as gradually increasing the retirement age, adjusting benefits, or modifying the formula for cost-of-living adjustments. While politically challenging, these reforms are essential to prevent these programs from overwhelming the federal budget in the future.

Economic growth plays a crucial role in managing the debt-to-GDP ratio. A growing economy increases revenue without the need for tax increases or spending cuts. Policies that promote innovation, improve productivity, and encourage investment can help stimulate growth. This includes investing in education, infrastructure, and research and development.

Additionally, trade policies that expand markets for U.S. goods and services can support economic growth. A balanced approach to globalization, which protects domestic industries while promoting exports, can help sustain economic expansion and improve the government’s fiscal position.

Addressing the financial health of the U.S. government requires political will and bipartisan cooperation. The challenges posed by high debt levels and interest payments are not insurmountable, but they do require difficult decisions and a willingness to compromise. Policymakers must prioritize long-term fiscal health over short-term political gains.

Public awareness and engagement are also crucial. Educating citizens about the implications of high debt levels and the importance of fiscal responsibility can help build support for necessary reforms. A well-informed electorate is more likely to support policies that ensure the long-term stability and prosperity of the nation.

The growing interest payments on the U.S. government’s debt, now consuming 30% of revenue, signal a critical juncture for fiscal policy. The implications are profound, affecting economic stability, public investment, and the government’s ability to respond to future crises. Addressing this issue requires a comprehensive approach that includes tax reform, expenditure management, entitlement reform, and policies that promote economic growth. Above all, it requires political will and public support to make the difficult decisions necessary to ensure the long-term financial health of the nation. By taking proactive steps now, the U.S. can navigate these challenges and secure a stable and prosperous future for its citizens.

Leave a Reply