Wealth tax, a levy on the net worth of individuals, is a topic of renewed interest in India amidst growing economic disparities. Understanding its potential reintroduction requires examining the global scenario, historical context, and economic implications.

India had a wealth tax in place from 1957 until its abolition in 2015. Initially, it was imposed to curb the concentration of wealth and generate revenue. However, due to administrative challenges, high compliance costs, and relatively low revenue generation, the wealth tax was discontinued. The government then introduced a surcharge on the super-rich to compensate for the loss of revenue.

Globally, the concept of a wealth tax has seen varied acceptance. Countries like France, Norway, and Spain have implemented it, while others like Sweden and Germany have abolished it due to practical difficulties. In France, the wealth tax was restructured into a real estate wealth tax in 2018 due to its perceived negative impact on investment and economic growth. Conversely, Spain continues to levy wealth tax to address economic inequality.

The United States has debated wealth tax proposals, particularly from progressive politicians like Elizabeth Warren and Bernie Sanders, who argue it could reduce inequality and fund public services. However, concerns about constitutionality and enforcement persist.

Economic Implications of a Wealth Tax

1. Revenue Generation

One of the primary benefits of a wealth tax is revenue generation. For India, which faces fiscal deficits and the need for substantial investment in public goods, a wealth tax could provide a new revenue stream. This is particularly pertinent post-pandemic, as the government seeks to bolster healthcare, education, and infrastructure.

2. Reducing Economic Inequality

A wealth tax can potentially reduce economic disparities by redistributing wealth from the rich to the broader society. This is significant in India, where the wealth gap has widened significantly, with the top 1% holding a substantial portion of the country’s wealth. Redistribution through a wealth tax could enhance social cohesion and provide more equal opportunities.

3. Economic Efficiency and Investment

Critics argue that a wealth tax can discourage investment and economic efficiency. High net worth individuals might move their capital abroad to avoid taxation, leading to capital flight. Moreover, it might dampen entrepreneurial activities and innovation if wealthy individuals perceive the tax as punitive.

4. Administrative Challenges

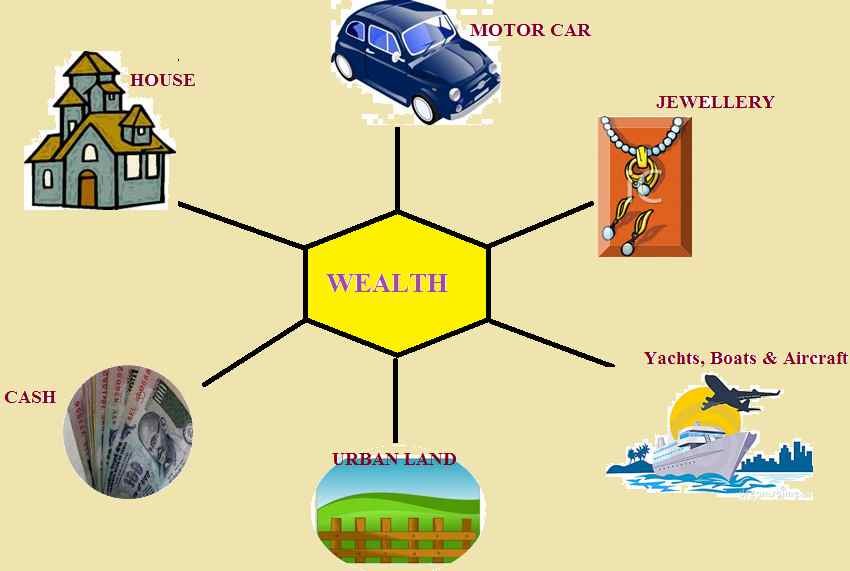

Implementing a wealth tax involves substantial administrative challenges. Valuing assets accurately, especially non-liquid assets like real estate, artworks, and business shares, is complex and can lead to tax evasion. Ensuring compliance and dealing with legal challenges also adds to administrative burdens.

Potential Framework for India

If India were to reintroduce a wealth tax, careful design is crucial to mitigate potential downsides:

1. Thresholds and Rates

Setting high exemption thresholds can target the ultra-rich while avoiding overburdening the upper-middle class. Progressive rates, increasing with the level of wealth, can ensure the tax is equitable.

2. Valuation Mechanisms

Developing robust valuation mechanisms for different asset classes is essential. This might involve periodic assessments and standardized valuation protocols to reduce disputes and evasion.

3. International Cooperation

To prevent capital flight, India could engage in international cooperation and data sharing. Agreements with tax havens and adherence to global standards can enhance transparency and compliance.

4. Simplifying Compliance

Simplifying compliance procedures through digital tools and reducing the bureaucratic burden can encourage voluntary compliance and reduce administrative costs.

Implications for the Indian Economy

1. Social Equity

A well-implemented wealth tax can enhance social equity by redistributing wealth and funding public services, thus improving living standards and reducing poverty.

2. Economic Growth

If the additional revenue from a wealth tax is efficiently utilized in infrastructure, healthcare, and education, it can spur long-term economic growth by improving human capital and productivity.

3. Investment Climate

Careful calibration is necessary to balance revenue generation and maintaining a favorable investment climate. Transparent and fair tax policies can maintain investor confidence.

Conclusion

The reintroduction of a wealth tax in India is a complex yet potentially beneficial policy move. While it promises to generate revenue and reduce inequality, careful consideration of its design and implementation is crucial to avoid economic inefficiencies and administrative burdens. Learning from global experiences and tailoring the policy to India’s unique context can pave the way for a more equitable and prosperous society.

Leave a Reply